.jpg?width=5287&name=blog%20images%20(2).jpg)

With Medicare open enrollment right around the corner, we want to help bring some awareness to a few changes that will be implemented. The Open Enrollment Period will run from October 15 - December 7 each year.

During Medicare open enrollment, you can make changes like:

- Switch from Medicare Advantage back to original Medicare.

- Cancel prescription drug coverage.

- Change from one Medicare Advantage plan to another.

- Sign up for a Part D prescription drug plan.

- Change from one Part D prescription plan to another.

- Disenroll from original Medicare and enroll in Medicare Advantage.

Medicare Eligibility

For most Americans, Medicare eligibility goes hand in hand with turning 65, although it’s possible for some people to become eligible for Medicare before their 65th birthday.

Typically, Medicare beneficiaries receive Medicare Part A without a monthly premium, but some will have to pay for it, with some having to pay more than the standard amount for their Medicare Part B and Part D coverage.

You may become eligible to receive Medicare benefits based on any one of the following:

- You are age 65 or older.

- You are younger than 65 with a qualifying disability. Medicare eligibility begins after 24 months of receiving Social Security disability benefits.

- Any age with a diagnosis of End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also called Lou Gehrig's Disease).

Medicare is available to United States citizens and legal residents who have lived in the United States for at least five years consecutively.

Remember, changes made during open enrollment will not take effect until January 1, 2022.

During Medicare’s annual window, enrollees can reevaluate their coverage and make changes or purchase new policies. Before taking any steps to get a plan or change, it’s important to learn about the changes happening for 2022.

The Medicare changes in 2022 include:

- Part A deductible rose from $1,364 to $1,408.

- Medicare Part B premium increased to $144.60 per month, a rise of $9.10.

- The Part B deductible increased from $185 to $198.

- Part D donut hole has been closed.

- Newly eligible Medicare members are no longer eligible for Medigap Plan C and Plan F.

- The high-income premium brackets for Medicare Part B and D have risen to $87,000.

- The full scope of Medicare changes in 2022 has yet to be revealed, but below, you will find an up-to-date breakdown of the changes you can expect.

There are a few options when it comes to Medicare with the 2 main ways being Original Medicare or Medicare Advantage.

Cost

Original Medicare: You pay a monthly Part B premium and any copayments, coinsurances, and deductibles. There’s no limit to how much you can pay out of pocket, but you can buy a Medicare Supplement Insurance (Medigap) policy to help.

Medicare Advantage: You pay the monthly Part B premium, plus the plan’s premium (if they have one). You also pay any copayments, coinsurances, and deductibles, but once you reach the plan’s yearly maximum, you’ll pay nothing for health services for the rest

.webp?width=795&height=530&name=blog%20images%20(3).webp)

Coverage

Original Medicare: Covers services and supplies in hospitals, doctors’ offices, and other health care settings under Part A (Hospital Insurance) or Part B (Medical Insurance). You can add drug coverage by joining a Medicare drug plan.

Medicare Advantage Plans: Must cover all services and supplies that Original Medicare covers, and most include drug coverage.

Doctor and hospital choice

Original Medicare: You can go to any hospital and use any doctor that accepts Medicare.

Medicare Advantage: You may need to use doctors and hospitals in that plan’s network.

Compare all options to get the coverage that will best fit your needs. To find a Medicare plan, click here.

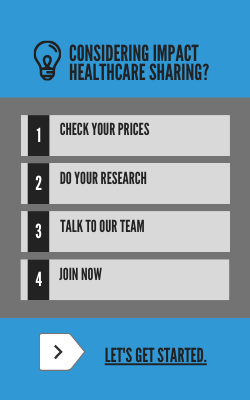

Does Impact Health Sharing have an option for those on Medicare?

Yes. Individuals age 65 and older with Medicare Parts A and B can be members of Impact.

Impact members will Share in the portion of your Eligible Medical Bills that Medicare allows but does not pay completely, including:

- provider fees

- deductibles

- hospitalizations

- skilled nursing facility care

- out-of-country urgent care

The PRA for senior adults is $1,000 with no Provider Fee, no Co-Share, and no Preexisting limitation.

Learn more about membership with Impact here. We are here to answer your questions and help you choose what’s best for your unique situation.

.jpg?width=300&name=blog%20images%20(2).jpg)