Healthcare can feel confusing, expensive, and rarely designed with health-conscious people in mind.

At Impact Health Sharing, we offer a different path: a smarter, more flexible solution that rewards your healthy lifestyle and provides real, affordable options for managing your healthcare costs.

How It Works

Impact Health Sharing isn’t insurance. We’re a modern, non-profit community where members share in each other’s eligible medical expenses—built on the principles of loving your neighbor and putting people over profits.

Many traditional solutions take a one-size-fits-all approach that often doesn’t align with today’s health-conscious consumer. At Impact, members enjoy the freedom to choose their own providers, avoid network restrictions, and always with transparent pricing.

Since 2020, Impact members have saved and shared over $150 million in eligible medical expenses—saving an average of 30–50% per month. And with our exclusive Wellness Rewards program, members can lower their annual Primary Responsibility Amount (PRA), which is similar to a deductible, by up to $150/month per household just by making healthy, intentional choices.

Built Different. On Purpose.

Impact reimagines healthcare sharing with tech-forward tools, radical transparency, and a values-driven approach to care.

What You Can Expect:

- 30–50% average monthly savings

- Fair, straightforward pricing with programs starting as low as $73/month for individuals, $378 for families

- Complimentary 24/7 Virtual Telehealth

- Complimentary Annual Wellness Visit + $150 Lab Credit per member

- Freedom to choose your providers

- No utilization reviews—we trust you and your provider to decide what’s best

- Access to even more savings on prescriptions, dental, and vision

- Year-round enrollment—no Open Enrollment deadlines

- Exclusive Wellness Rewards (up to $150/month per household in annual PRA reductions)

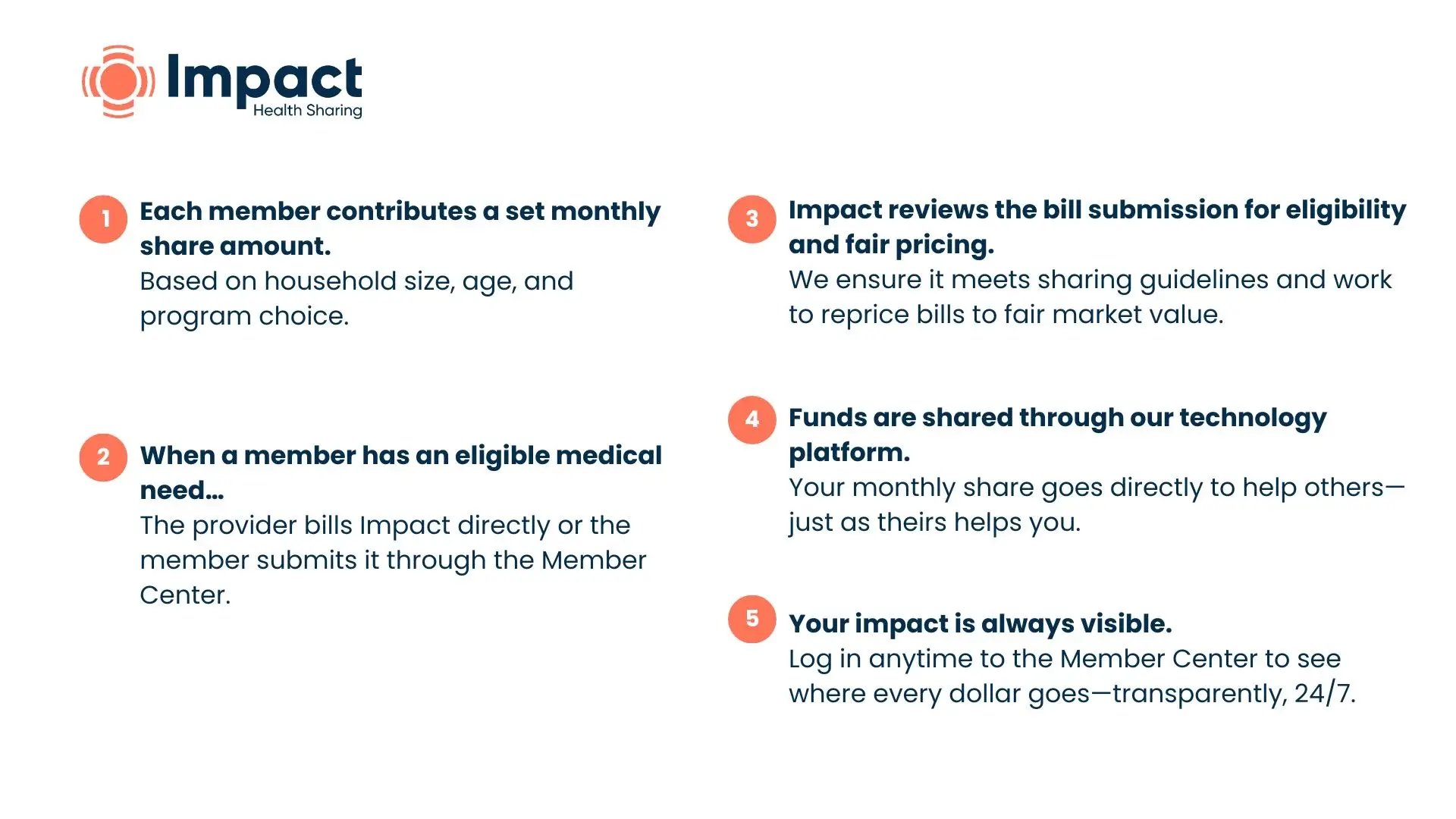

How Sharing Works: Together, We Make Healthcare Work & Feel Better

You choose an Annual Household Primary Responsibility Amount (PRA), similar to a deductible. It’s the amount your household (not individual) is responsible for each year before additional eligible expenses are shared by the Impact community.

- Higher annual PRA = lower monthly share amount

- Lower annual PRA = higher monthly share amount

- You can reduce your annual PRA with Wellness Rewards

Wellness Rewards

We recognize the effort and investment you put into living well. With Wellness Rewards, you can reduce your annual PRA by up to $150/month per household. Simply submit receipts for wellness-related purchases—like supplements, gym memberships, or massage therapy—through the Member Center.

-Jul-19-2025-08-18-08-8690-PM.webp?width=950&height=700&name=blogImages%20-%20Impact%20)-Jul-19-2025-08-18-08-8690-PM.webp)

Preventive Care

Every member receives one complimentary annual wellness visit per year (ages 6+), 100% shared by the community. Plus, up to $150 annual lab credit is also complimentary for every member per year.

No Network Restrictions

You have the freedom to see any provider you choose. No in-network requirements. No referrals needed.

Provider Fees

- $0 for Virtual Telehealth

- $50 for Office Visits

- $75 for Specialists, Urgent Care, Teletherapy, or Outpatient Services

- $150 for ER and Inpatient Hospitalizations

Doctor Visits

Bring your Impact Member ID card to your appointment and pay the provider fee at check-in. Your provider submits the bill to Impact, which reviews it for eligibility and fair pricing. Once your annual PRA is met, eligible bills are shared at 90% with the community, with you responsible for just 10% (up to a $5,000 max annually).

Pre-Existing Conditions

Once you become a member, new medical needs that meet our Guidelines can be considered for sharing by the community after your annual PRA has been paid.

It's important to understand how pre-existing conditions may affect your membership.

A pre-existing condition is any health issue where you’ve had signs, symptoms, testing, treatment, diagnosis, or use of medication in the 36 months before joining. These conditions are not eligible for sharing.

Your medical records are used to verify eligibility for sharing, based on our published Guidelines. However, thoughtful exceptions exist for certain conditions like heart disease, stroke, and cancer. See the Impact Guidelines to learn more.

Prescriptions

Members enjoy access to wholesale pricing on prescriptions through a premier network of 65,000 pharmacies. In 2024, Impact members collectively saved over $6 Million in prescription costs!

Prescription medication expenses may be credited toward the annual PRA if they are not considered a treatment for chronic conditions that were pre-existing when the member joined Impact. After the Member’s annual PRA has been paid, the prescription amount may be shared as follows:

- After the first $25 on a generic drug prescription.

- After the first $50 on brand name prescription when a generic is unavailable.

- Prescription medications* must be purchased using the Impact Member ID card.

- Members pay 100% of the prescription amount at the pharmacy.

- Prescription drugs may be dispensed, injected, or administered.

*Psychotropic medications and birth control expenses are not eligible for Sharing.

The sharable amount is limited to $1,200 per member, per membership year after the annual PRA has been paid.

Exceptions may be made in the case of medications for cancer and transplant recipients.

Dental and Vision Savings

Impact has partnered with VSP® Individual Savings Pass™ and Careington Dental Savings Network. We’re offering you access to substantial savings on eye care, eyewear, and dental procedures for you and your household at no additional cost. How Do I Use the Savings Pass?

Options for Adults 65+

If you have Medicare Parts A and B, you can still join Impact through our dedicated Senior Program—designed to complement Medicare while giving you added flexibility and support.

Significantly More Affordable—With No Surprises

Whether you’re self-employed, paying out of pocket, or seeking a smarter option for your dependents, Impact can help you save. You can even keep employer-provided insurance for yourself and enroll your spouse or children in Impact for added savings.

Get a free quote in seconds to see if you could be saving 30-50% this time next month! No commitments. No hidden fees. Just real savings and clarity.

Live Well. Spend Smart. Choose Freedom.

Ready to see if Impact is the right fit for your healthcare needs and your budget? Read the full Guidelines, check out our Help Center, or ask Ellie—our super smart AI chatbot.

Get your free quote—it’s faster than your coffee order and could save you hundreds each month.

Savings Disclaimer

Examples in these materials are not to be interpreted as a promise or guarantee of savings. The savings potential depends entirely on the individual member's circumstances and program choices.