Tired of high premiums and complicated insurance rules? You’re not alone. Many Americans are exploring healthcare sharing as a simpler, more affordable way to handle medical expenses.

While insurance has historically been the “standard,” healthcare sharing programs offer a fresh, community-driven alternative that’s gaining momentum, especially for people who value flexibility and transparency.

In this post, we’ll break down how both models work, what makes them different, and why more families are choosing healthcare sharing over insurance.

What Is Healthcare Sharing?

Healthcare sharing is a community-based approach to managing medical costs. Instead of paying premiums to an insurance company, members contribute a monthly share that helps satisfy other members’ eligible medical bills.

When a member has an eligible need, it’s submitted for sharing, and other members’ monthly contributions help pay it—like neighbors helping neighbors.

While it’s not insurance, healthcare sharing programs like Impact Health Sharing operate with structure, transparency, and fairness. Each household agrees to shoulder their own medical costs up to a set amount, often called a Primary Responsibility Amount (PRA), similar to a deductible, before expenses can be shared.

Key Advantages

- Lower monthly costs than most ACA insurance plans

- Freedom to choose your provider—no restrictive networks

- Shared community values—members support each other directly

- Simplified billing—no hidden fees or complex tiers

Instead of funneling money through large insurance bureaucracies, sharing programs prioritize people, not profits.

How Traditional Solutions Work

Insurance operates as a business contract between you and an insurer. You pay monthly premiums in exchange for a “promise” that the insurer will cover certain medical costs within strict limits.

While insurance plans are regulated under the Affordable Care Act (ACA) and must cover essential benefits, the reality can be more complicated.

The Fine Print Behind “Guaranteed” Coverage

Although insurance companies are legally obligated to honor covered claims, many people discover that coverage doesn’t always mean payment.

Claims can be denied, partially reimbursed, or stalled in red tape. In fact, studies show that a significant portion of ACA marketplace claims are denied each year, often for reasons as small as missing paperwork or “not medically necessary” judgments.

On the flip side, while healthcare sharing is not insurance and has no stated guarantee, many, including Impact Health Sharing, have a strong track record of meeting member needs.

So, while insurance may seem like a guarantee, the peace of mind it promises can quickly vanish when unexpected denials or billing disputes occur.

Pros & Cons: Healthcare Sharing vs. Insurance

The Advantages of Healthcare Sharing

- Lower Monthly Costs

Healthcare sharing members often pay hundreds less each month than those on ACA or employer insurance plans. This savings adds up, especially for families and self-employed individuals. - Freedom of Choice

With most sharing programs, you can see any provider you want. No in-network or out-of-network penalties. - Community Over Corporations

Instead of paying premiums to profit-driven companies, your dollars go directly toward helping real people in need. - Transparent Process

Members know exactly where their money goes, with clear sharing rules and no surprise billing. - Moral and Lifestyle Alignment

Many healthcare sharing communities unite people with shared values, emphasizing personal responsibility and healthy living. - No Bureaucratic Claim Battles

Because healthcare sharing isn’t insurance, members avoid the frustration of denied claims and hours spent appealing decisions. Just be sure to read and understand your program guidelines before seeking care.

The Drawbacks of Insurance

- High Premiums, Even If You’re Healthy

Overall costs can be steep—often thousands more per year—even if you rarely use healthcare. - Complex Rules and Denials

Despite “guaranteed” coverage, insurers deny or delay claims for millions of Americans each year. It’s not unusual for patients to fight for months to get seemingly covered care paid. - Limited Provider Networks

Many plans restrict which doctors or hospitals you can use, leading to surprise bills when care falls outside the network. - High Out-of-Pocket Max

Even with insurance, you could face a $9,000+ out-of-pocket max before your plan pays 100%—and that’s only for approved services. - Lack of Transparency

Insurance billing is notoriously complex, making it hard to understand, let alone predict your true costs.

Potential Drawbacks of Healthcare Sharing

- Not Legally Guaranteed

Sharing is voluntary, not a legal contract. However, well-established organizations like Impact Health Sharing have strong records of reliability and transparent systems that give members confidence and peace of mind. - Exclusions and Waiting Periods

Some conditions or treatments may have limited sharing eligibility, especially pre-existing ones. - Upfront Costs Before Sharing Begins

Members must first pay their PRA, but this functions similar to a deductible—often at a lower level than many insurance plans.

Why Many Are Switching to Healthcare Sharing

In an era of skyrocketing premiums, rising deductibles, and confusing insurance bureaucracy, healthcare sharing offers a refreshing alternative. Members enjoy affordability, choice, and community connection—without navigating endless claim forms or surprise denials.

Even though it’s not insurance, many find it delivers something better: trust and accountability. With transparent sharing guidelines and member-to-member support, it’s a model built on people helping people—not corporations maximizing profit.

The ACA’s Role

Under the Affordable Care Act (ACA), insurance companies must offer certain protections and benefits, but those regulations come at a cost. Premiums, out-of-pocket limits, and administrative overhead continue to rise.

Healthcare sharing programs, exempt from ACA mandates, can stay lean and efficient—passing savings directly on to members.

For many families, this means more freedom, lower monthly expenses, and the ability to align healthcare choices with personal values rather than government mandates.

Final Thoughts

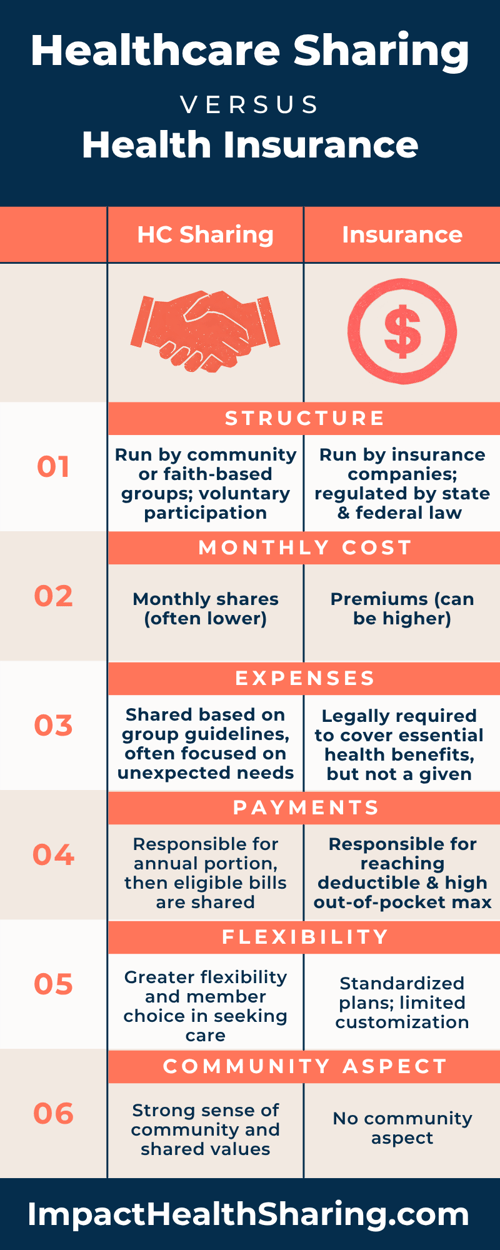

Healthcare sharing and insurance both aim to manage medical costs—but they operate on entirely different principles.

If you’re looking for affordability, flexibility, and a sense of community, healthcare sharing may be the smarter choice. While insurance touts “guaranteed” coverage, many have learned the hard way that guarantees don’t always translate into care without complications or denials.

Healthcare sharing puts you in control of your healthcare, offering real support, transparent costs, and peace of mind through community.