.jpg?width=5287&name=Blog%20Images%20-%20Impact%20(2).jpg)

What Happens When I Retire?

How, exactly, does Social Security work after you reach that magical full retirement age?

Here are a few important facts to bear in mind as you head towards retirement.

- Create your retirement budget and retirement income plan.

As you near your retirement date, consider your short- and long-term budget. In the short term, you'll have the last paycheck that may include back pay, vacation/sick days, commissions, or a bonus.

- Guaranteed income sources:

- Social Security, if you're taking it now

- Pensions (traditionally defined benefit plan)

- Annuities

2. Examine benefit end dates.

Some benefits may stop the day you're done with work, but others may extend by a set number of days.

If you have dental or vision insurance now but won't when you retire, schedule appointments before your last day while those expenses may still be covered. Impact Health Sharing has an excellent option for those with Medicare Parts A and B. Learn more about that later in this article.

Life insurance extension: You can usually keep renewing your policy year-to-year until you are 95 years old. Most term life policies have a guaranteed renewability feature that lets you extend your coverage. However, the insurance company will change your premium if you extend it. This may not be the best choice for most people. You can get a different policy or choose a conversion option or rider, which lets you convert your term policy into a permanent policy without having to provide evidence of insurability (i.e., getting a new medical exam). Different insurance companies have different ways of handling term-to-permanent conversion, so you'll need to look at your policy to see what your options are

3. Decide what to do with your retirement accounts.

American workers pay Social Security taxes on their income. If they have paid enough into the system by retirement by earning 40 work credits, they are eligible to receive benefits.

How much in benefits you'll receive depends on whether you take Social Security early or if you choose to wait until full retirement age. For people born from 1943 through 1954, the full retirement age is 66. However, the full retirement age gradually increases yearly until it reaches age 67 for those born in 1960 or later.

When you're ready to claim benefits, visit your local Social Security Administration (SSA) office, apply online at ssa.gov, or call 1-800-772-1213.

A few key takeaways

- Social Security income is an important source of income for retirees in America.

- The process of applying for Social Security and calculating benefits can be complex.

- Maximizing benefits may mean considering past income and age when deciding when to start benefits.

- Social Security benefits may be subject to taxation, especially if you are still working and receiving benefits.

Learn more about retirement here.

What Are Some of the Very First Things You Should Do When You Retire?

- Move somewhere new: Have you ever wanted to live in the country? Maybe it's time to sell your home and downsize in a completely different location.

- Travel the World. Make time to go places you have always wanted to explore but didn't have the time to.

- Get a Rewarding Part-Time Job. Find something you really enjoy, then get paid for it!

- Give Yourself Time to Adjust to a Fixed Income.

- Exercise More. Self-care is important, especially as you get older. Always include stretching as part of your exercise routine. Be sure to check with your physician before starting anything new to prevent accidents.

%20(1)%20(1).webp?width=795&height=530&name=Blog%20Images%20-%20Impact%20(3)%20(1)%20(1).webp)

As you explore the dos and don'ts of retirement, you may need help from a professional to get all your ducks in a row. Don't be afraid to ask for help. A financial professional can talk you through your options. Don't have one? Check with your HR contact to see if your company's retirement savings plan offers this service.

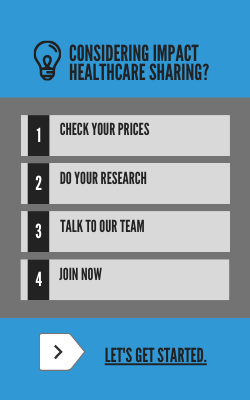

If you are a senior and you are looking for healthcare outside of open enrollment, Impact has an amazing option. Don't let medical care dwindle your available funds. The impact is great as a secondary option to Medicare Parts A and B. Prescriptions can be costly even with Medicare, and that's just one way that Impact can save you money.

Individuals 65 and older with Medicare Parts A and B can be members of Impact Health Sharing. And, with Impact Health Sharing, you will find many of the same things you expect from typical healthcare coverage and much more!

To check out pricing, use our calculator.

.jpg?width=300&name=Blog%20Images%20-%20Impact%20(2).jpg)