Five Money Habits That Hurt Your Retirement Savings

-3.webp?width=795&height=530&name=Blog%20Images%20-%20Impact%20(7)-3.webp)

Retirement planning can be intimidating regardless of age you start thinking about it, maybe even more so when you are just beginning your career. When retirement seems so far in the future, it can be difficult to start to plan for it. Your current situation and current needs are competing priorities. However, the sooner you start saving, the better off you’ll be in the long run. It would be wise to increase the amount you save over time, and it can make a significant difference and get your retirement savings on track.

There are some mistakes people have made that hurt your retirement savings, so let’s take a look.

Mistake #1: Failing to take full advantage of retirement saving plans.

Fully exploiting an employer match is one of the most important strategies for getting the most out of your 401(k) plan. It’s vital to set a specific per-paycheck amount and leave it be unless necessary. This effectively doubles your retirement savings without decreasing your salary or increasing your tax burden.

Mistake #2: You're putting off savings until you make more money.

When you're already struggling to pay the bills, it's easy to put saving for retirement on the back burner. Maybe you have been telling yourself that you'll start saving again as soon as you get that raise, after you pay off more debt, or after you take that dream vacation next year. But putting off saving for just one year can hurt you in the long term -- even if you save more down the road to try to make up for it.

Mistake #3: Not Planning for Health Costs.

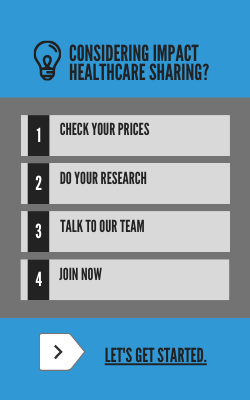

Medicare doesn't cover all retirement healthcare costs. Fidelity estimates that an average retired couple age 65 in 2021 may need approximately $300,000 saved (after tax) to cover health care expenses in retirement. Plan to purchase supplemental insurance or be prepared to pay the difference out of pocket. Impact for Seniors is an excellent choice for those that have Medicare Parts A and B. Impact for Seniors simplifies the healthcare experience. No Provider fees, No Co-share, and No Pre-existing limitations. Ready to learn more?

-2.webp?width=795&height=530&name=Blog%20Images%20-%20Impact%20(8)-2.webp)

Mistake #4: Living beyond your means.

Driving up debt ahead of retirement could hurt do some damage to your savings. Instead, cancel subscriptions and memberships you aren’t using—Cook meals at home instead of dining out. Shop for a better deal on car insurance. The temptation to spend your money can be tempting, but discipline is vital. Parents and their kids should explore scholarships, grants, student loans, and less expensive in-state schools instead of raiding the retirement nest egg.

Mistake #5: Underestimating the cost and length of retirement.

Overspending at any point in your life can be problematic. If you haven’t thought seriously about how you’d like to spend your time in retirement or where you’d like to live, you’re setting yourself up for failure. It’s wise to test out living on your monthly retirement budget while still bringing in an income from work.

“Those who fail to plan, plan to fail.”

Without a solid plan in place years before retirement, you’re setting yourself up for failure in your golden years. Retirement planning takes careful consideration, thoughtful strategy, soul searching, and insightful self-inventory.

-3.jpg?width=300&name=Blog%20Images%20-%20Impact%20(7)-3.jpg)